Smartest investment advice for a 26-year-old working professional?

Wondering what a mutual fund is and how to invest in one?

July 1, 2021

When selecting a debt fund what is the most important thing?

September 30, 2022Few Important Tips to start with:

- Keep realistic expectations (very important to be a successful investor)

- Be Patient (the most successful investors are those who stayed invested in bad times)

- Do your Risk Profiling to understand your risk appetite

- Define your Investment Horizon with Goals (can be multiple) in advance

- Invest post proper research and

- Always keep some buffer in hand to invest on dips

- Keep an emergency fund of INR 3–5 Lakhs in your savings account

- Always keep your self sufficiently Insured, through Life and Health Insurances (else all your emergency fund would get eroded in no time.

Assumptions:

- Rs 70,000 is your income in hand post deduction of taxes and EPF. This puts your in 20% Income Tax bracket.

- Monthly expenses are Rs 20,000 – 25,000;

- Excluding your expenses, you can invest a total of Rs 35,000 per month and keep remaining Rs 10,000–15,000 per month in your savings account as buffer funds.

- EPF deducted every month is approximately 7,000 per month, so INR 98,000 per year

- Currently you do not have any other insurance or investments !

- You do earn an additional performance bonus every year, amounting to around INR 1.50 Lakhs every year. This is to take care of your Insurance premiums and annual vacations.

- The investment amount is stable over time. It may not increase but would not reduce either.

- Your investment horizon would be around 30–35 years, considering the young age.

Now where all can you invest?

- With the current age being only 26 years, you can already invest to plan an early retirement. With an investment horizon being 30+ years, lets evaluate the available asset classes briefly:

- Stocks (Bluechip): Stocks are extremely risky. Invest in stocks only if you have a good knowledge of stocks. The returns can vary manifold, but I repeat, it is very risky and can also lead to erosion of wealth.

- However, in case you really want to invest in stocks, preferably invest only in bluechip stocks or do an Equity SIP in evergreen stocks like TCS, RIL, HDFC bank etc.

- Choose wisely, be up to date with corporate news and monitor your portfolio regularly.

- Mutual Funds (MFs): Mutual Funds are subject to market risk.

- So, diversify your MF investments and enter through SIP route to diversify risk.

- The advantage is you can start with pure equity portfolio and later shift to balanced or debt funds. Basis the historical performances, expectation of 12–15% from equity mutual funds is reasonable with diversified risk.

- Also, be consistent and disciplined in turbulent times of the market.

- ELSS: Invest the pending amount to complete requirement of Sec 80C in ELSS.

- Lowest lock-in of 3 years vis-a-vis other options.

- Highest returns in the last 10 years vis-a-vis other options.

- Public Provident Fund (PPF): A very safe option with an approximate return of 8% p.a.

- Lock-in of 15 years.

- You cannot expect a return of double digit in this category.

- I personally do not suggest investing in PPF for a young person.

- Tax savings under Sec 80C.

- National Pension Scheme (NPS): They invest in different funds, subject to the choice made by you at the time of investment.

- Lock-in of funds till the age of 60 years;

- They provide an additional rebate of INR 50,000 over Sec 80C.

- However, the catch here is that even after 60, you only get 60% of your accumulated corpus back while 40% would convert into annuity (consider it pension).

- The returns may be in the range of 8–12%

- Fixed Deposits (FDs): Again FDs are considered to be a safe option and for conservative investors.

- The returns are considerably lower than most other assets.

- Also, they vary from entity to entity and may be in the range of 7–8% p.a. in the long run (considering current market scenario).

- Tax saving FDs have lock-in of 5 years.

- UPDATED POINT: Non Convertible Debentures (NCDs): Non convertible debentures (NCDs) are fixed-income instruments, usually issued by high-rated companies. They offer higher interest rate than convertible debentures.

- Great option if you are looking at fixed returns over a period of time.

- They offer coupons (returns) across various frequencies like monthly, annual or cumulative.

- It does have a lock-in period which would vary as per the companies requirement of funds. May be 24 months to 120 months as per recent trends. You may choose your preferred horizon.

- NCD works as a type of loan that is issued by a company, which cannot be converted to equity.

- They are higher risk in nature when compared to a bank fixed deposits, since they run the risk of the issuer defaulting on repayments, and offer higher risk-reward ratio.

- Secured NCDs are safer than unsecured ones.

- Recent NCDs (Jan-May 2019) have offered return in the range of 9.5 % – 11% in the 5 year lock-in period.

- Gold or Gold bonds: This is one asset I feel has reached its saturation level and would not grow multifold (except in case of a war-like adverse scenario where only Gold may survive).

- Gold remains illiquid asset and Indian households tend to just keep it forever, rather than sell it in times of distress.

- If you want to still invest in gold, Sovereign gold bonds offer 2.5% p.a. interest rate in addition to the appreciation of gold prices. So a much better option than physical gold.

- Real estate: It is not a good option considering

- It is a highly illiquid asset and would be pretty expensive.

- Also, the real estate boom seems to be a fad now.

Which asset class would I pick?

Talking about my personal preference, I would prefer spreading my investment in Mutual Funds and Equity SIP in the ratio of 70:30 and change the structure every 8-10 years, moving towards a safer investment product.

- Mutual Funds (SIP of Rs 25,000 per month)

- 20% Large cap (Rs 5,000 per month)

- 20% Large & Midcap (Rs 5,000 per month)

- 20% Multicap (Rs 5,000 per month)

- 20% Mid cap (Rs 5,000 per month)

- 20% Small cap (Rs 5,000 per month)

- Do ensure you choose the right schemes from this set (not only looking at past returns but also other factors)

- Equity SIP (Rs 10,000 per month) – I prefer the following stocks to do my equity SIP, i.e. purchase one share per month of the following scrips:

- HDFC Bank (Rs 2,293 currently)

- TCS (Rs 2,152 currently)

- RIL (Rs 1,309 currently)

- HUL (Rs 1,688 currently)

- Bata (Rs 1,349 currently)

- You may occasionally purchase additional amount in case of drastic dip in the market.

- Considering it is still a young age, one can afford to take some risks.

- If I were to park some funds in Debt, I would look at good Secured Redeemable NCDs.

- Mutual Funds do not require daily monitoring, timely review is sufficient. Ideally I review my portfolio at least once every 6–12 months.

- However, stocks need regular monitoring and should be tracked daily.

Calculations (Numbers are enticing, aren’t they?)

Lets analyze some numbers and do some calculations to understand the POWER OF COMPOUNDING !!

Sensex over the last 40 years (since inception) has grown 390 times, at a CAGR of 16.1 %.

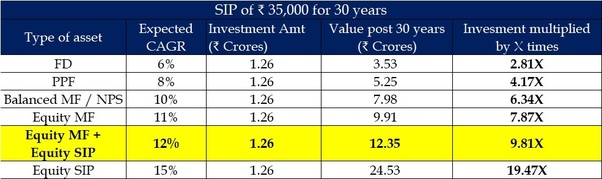

However, past performance may not be always repeated in the future, so, let us take returns for various assets and understand how the wealth would be different in 30 years !!

Table I – 35,000 per month for 30 years !!

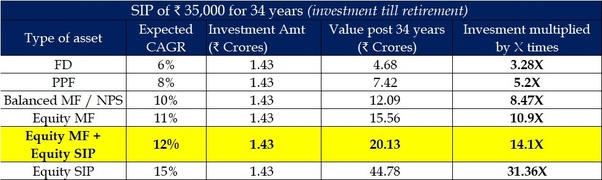

Table II – 35,000 per month for 34 years (i.e. till the age of 60 years) !!

So, if you hold and continue your SIP for an additional 4 years, you end up richer by another INR 8 Crores (YES, 8 crores more !!)

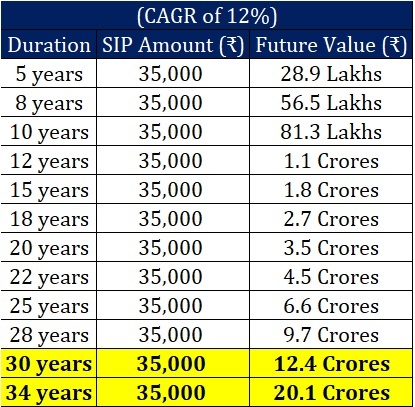

Table III – 35,000 per month at 12% CAGR for 34 years !!

- This table shows the amount you should be able to generate at different points of time during your investment tenure and also truly shows the power of compounding.

- The amount you generate in first 20 years multiplies more than 5 times in the next 14 years.

Advice:

- Plan and start investing at the earliest to generate wealth and retire early and rich.

- Do proper research and/or contact a financial advisor to invest in the right asset classes to ensure optimum returns.

- What people tend to feel is why pay a fee to the advisor. Let us check online and invest. However, past returns may mean the scheme has reached saturation and will not repeat the performance.

- Further, a lot of people tend to forget is that even a 1% difference in returns can create a gap of almost 5 Crores in your long term returns (refer Table II), so 5–10K is a small amount to pay for proper planning and advice.