Wondering what a mutual fund is and how to invest in one?

Are open-ended bond funds suitable for credit risk in India?

July 1, 2021

Smartest investment advice for a 26-year-old working professional?

July 1, 2021a. MRF share is trading at approx. INR 53,000 per share. I may want to invest in auto sector or consumption theme like this but I only have Rs 5,000 every month. WHAT DO I DO?

b. I like banking and financial services sector. However, I do not want to invest in shares of one bank but rather want one share each of HDFC Bank, ICICI Bank, Axis Bank and Kotak Bank. But I only have an investible surplus of INR 5,000 each month. WHAT DO I DO?

The answer to these questions is investing in the right mutual funds, as per your requirement. Now the question is:

What are Mutual Funds or MFs?

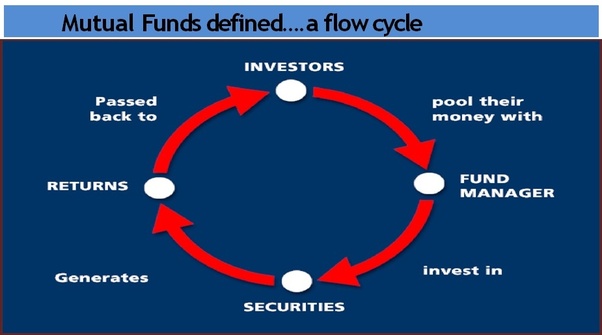

A mutual fund, as the name suggests, is created when the capital collected from different investors (pool of investors) is invested in company shares, stocks or bonds. e.g. Say INR 10,000 is contributed each by 100,000 investors to create a corpus of INR 100 Crores. This will then be invested in various securities and each investor will get the units in the ratio of his investment.

- In other words, it is a vehicle to mobilize money from investors, to invest in different markets and securities, in line with the investment objectives agreed upon, between the mutual fund and the investors.

- The cost of investment is very low, as it is split across a number of investors.

- Also, through investment in a mutual fund, an investor can get access to markets that may otherwise be unavailable to them and avail of the professional fund management services offered by an asset management company. This answers our questions at the start.

How can one Invest in Mutual Funds?

- You will need to get your KYC done for investing in MFs. You can check if your KYC is already done or not here: KYC Inquiry

- Invest Online

- Through respective AMC websites

- Through Demat Account Providers (who act as distributors)

- Through online platforms licensed to Individual MF Distributors or Advisors (BSE MF Star / NSE MF platforms are the common ones)

- Through online distributors like Coin by Zerodha, Paytm money, etc.

- Offline Investment – You would need a cheque for investment in this case. You can invest in the following through:

- Request your financial advisor for the investment forms.

- You can reach out to the respective registrars (RTAs) in person and request for the forms there.

- The AMCs serviced by these registrars are as follows:

- AMCs serviced by CAMS

- AMCs serviced by Karvy

- Franklin only services Franklin Templeton AMC

- Sundaram – Services BNP Paribas and Sundaram AMCs.

Now the next important question people have is why should they invest in Mutual funds? So lets look at the:

Advantages of Mutual Funds:

- Professional Management:

- MFs offer an opportunity to investors to earn an income or build their wealth through professional management of their investible funds.

- Mutual fund investment simplifies the process of investing and holding securities. Investing in the securities markets otherwise shall require the investor to open and manage multiple accounts and relationships such as broking account, demat account and others, which is not mandatory with mutual funds

- Affordable Portfolio Diversification:

- How true is the above axiom? Portfolio in mutual funds are diversified, as per the mandate of the scheme.

- Investing in the units of a scheme provide investors the exposure to a range of securities held in the investment portfolio of the scheme in proportion to their holding in the scheme. Thus, even a small investment of Rs. 500 in a mutual fund scheme can give investors proportionate ownership in a diversified investment portfolio.

- E.g. If a fund of INR 100 crores has invested in 50 stocks (INR 2 crores each), then an investor who has invested INR 10,000 in the fund would get 0.001% exposure to each stock.

- Economies of Scale:

- Pooling of large sum of money from many investors makes it possible for the mutual fund to engage professional fund managers / researchers for managing investments, which otherwise may not have be possible for individual investors with with small amounts to invest cannot.

- Another instance is the costs related to investment research and office space gets spread across investors.

- Further, the higher transaction volume makes it possible to negotiate better terms with brokers, bankers and other service providers.

- Mutual funds give the flexibility to an investor to organize their investments according to their convenience.

- For example, investment in gold and real estate require a large outlay. Similarly, an effectively diversified equity portfolio may require a large outlay. Mutual funds offer the same benefits at a much lower investment value since it pools small investments by multiple investors to create a large fund.

- Also, various option like dividend and growth options of mutual funds allow investors to structure the returns from the fund in the way that suits their requirements.

- Liquidity:

- Certain people would have faced this problem when they are stuck with a security for which they can’t find a buyer or at times, can’t even find the company they invested in! Such investments are technically called illiquid investments and may result in heavy losses for the investor.

- However in comparison, most mutual funds are highly liquid. as per their structure allow one to redeem the units at the given market rates. There are certain exceptions here:

- ELSS or tax-saver mutual funds have a lock-in of 3 years, and cannot be withdrawn before that.

- Close-ended funds are locked-in for a pre-defined period.

- Interval funds are open for select intervals for trading.

- Units from open-ended funds can be purchased or redeemed anytime. However, there might be exit loads associated with them. So do read the scheme related document before investing.

- Tax Deferral:

- Mutual funds are not liable to pay tax on the income they earn. If the same income were to be earned by the investor directly, then tax may have to be paid in the same financial year.

- Mutual funds offer options, whereby the investor can let the money grow in the scheme for several years. By selecting such options, it is possible for the investor to defer the tax liability. This helps investors to legally build their wealth faster than would have been the case, if they were to pay tax on the income each year.

- However, you must look at the other applicable taxes like LTCG and STCG as well – Taxation on MFs in India.

- Tax Benefits:

- Specific schemes of mutual funds, called Equity Linked Savings Schemes or ELSS give investors the benefit of deduction of the amount subscribed under Sec 80C (upto INR 1,50,000 in a financial year), from their income that is liable to tax.

- For a person in the 30% tax bracket, this amounts to approximately INR 46,000 per year.

- Just to bring a numeric perspective, if this saved amount was invested in equity (say SIP of INR 4,000 per month) for last 20 years, this would have become INR 70 Lakhs today !! (CAGR of 16% taken for last 20 years)

- Convenient Options, Investment & Regulatory Comfort:

- The options offered under a scheme allow investors to structure their investments in line with their liquidity preference and tax position.

- It provides great transaction conveniences like:

- Ability to withdraw only part of the money from the investment account

- Ability to invest additional amount to the account

- Setting up systematic transactions, etc.

- It is very convenient for the investor to make additional or further purchases with very little documentation.

- SEBI, the regulator for all securities in India, has mandated strict checks and balances in the structure of mutual funds and their activities. These checks ensure protection of investors from any fraudulent activities.

Categories and Sub-Categories of Mutual Funds !!

Let us look at the various categories of Indian Mutual Fund Industry:

- Equity Mutual Funds: Invest primarily in Stocks listed on BSE / NSE.

- Large Cap Fund (Bluechip): These mutual funds invest in Top 100 stocks (basis highest market capitalization) listed in the Indian markets.

- Larger stocks are expected to be less risky and have stable growth expectation.

- Invest with a minimum horizon of 5 – 7 years.

- Mid Cap Fund: These mutual funds invest in stocks ranked 101 to 250 (basis highest market capitalization).

- Larger stocks are expected to be less risky whereas smaller stocks may have higher potential to grow. Hence, mid-caps are riskier than large cap stocks.

- Invest with a minimum horizon of 10 years.

- Small Cap Fund: These mutual funds invest in stocks ranked 251 onwards.

- Smaller stocks are highly risky and also have a higher potential to grow. Hence, small-caps are riskier than large & mid cap stocks.

- Invest with a minimum horizon of 10 – 15 years.

- Multicap Funds: These mutual funds have their investments spread across large cap, mid-cap and small cap stocks.

- Ideal for people looking at taking a little bit of risk but not too high.

- Invest with a minimum horizon of 7 – 10 years.

- Large & Midcap Funds: These funds have their investments spread across large cap and mid-cap stocks only.

- Invest with a minimum horizon of 5 – 7 years.

- Value Funds: These mutual funds invest in stocks which are undervalued.

- The underlying assumption is, stocks may be undervalued due to temporary factors and will provide higher returns compared to peers once valuation is at par.

- These can be considered as risky as mid-cap stocks

- Invest with a minimum horizon of 7 – 10 years.

- Contra Funds: These mutual funds invest in stocks and follow a strategy of purchasing and selling in contrast to the prevailing sentiment.

- The underlying assumption is that herd behavior among investors often makes the market very costly or very cheap at times.

- These can be considered as risky as value funds.

- Invest with a minimum horizon of 7 – 10 years.

- Focused Funds: These mutual funds invest in stocks but restrict the number of stocks in the portfolio to a maximum of 30.

- Theme is similar to multicap funds, only capped at 30 stocks at maximum.

- Invest with a minimum horizon of 7 – 10 years.

- Equity Linked Savings Scheme (ELSS): These mutual funds maintain portfolio largely in the stocks (equity).

- Tax Benefit up to Rs 150,000 under Sec 80C can be claimed every year by investing in these funds.

- These have an exit load of 3 years.

- Sectoral / Thematic Funds: These mutual funds invest in stocks selected from single sector or fits in specific theme, like infrastructure, FMCG, BFSI, Consumption theme etc.

- They only invest in a particular theme or sector and hence are extremely risky, or can be said to be riskiest of all mutual funds.

- No minimum investment horizon. Technology sector has given 50% returns in last one year, however, only gave single digit returns over the last 3–5 years. Very periodic in nature.

- Large Cap Fund (Bluechip): These mutual funds invest in Top 100 stocks (basis highest market capitalization) listed in the Indian markets.

- Hybrid Mutual Funds: They invest in a combination of equity and debt.

- Aggressive Hybrid Funds:

- Also called Equity oriented balanced funds.

- Invest 65-80% in stocks and 20–35% in bonds.

- Invest with a minimum horizon of 4–5 years.

- Conservative Hybrid Funds:

- Also called Debt oriented balanced funds.

- Invest 75–90% in debt and 10–25% in stocks.

- Invest with a minimum horizon of 3 years.

- Also provide indexation benefit post 3 years of investment.

- Equity Savings Funds:

- Invest in Equity and Equity Arbitrage positions and Debt.

- 65% exposure is maintained in Equity Funds.

- Invest with a minimum horizon of 1-3 years, safer option with LTCG benefit after 1 year.

- Arbitrage Funds:

- These mutual funds invest in both Stocks and Bonds.

- The focus is to take arbitrage position in stocks so that there is no impact of stock price change

- Fund can generate fixed returns over a period from arbritrage available in prices of stocks/futures.

- Can invest even with a short term horizon.

- Others: There are other hybrid funds like:

- Dynamic Asset Allocation or Balanced Advantage: Allocation between debt and socks can vary as per market conditions.

- Multi-Asset Allocation: These mutual funds invest in at least 3 asset classes with at least 10% in each asset classes.

- Capital Protection Funds: These ensure your capital is protected at all times.

- Aggressive Hybrid Funds:

- Debt Mutual Funds: Invest primarily in different bonds and debt instruments, of varying maturities and risks.

- Overnight Funds:

- These mutual funds invest in overnight instruments with maturity of 1 day.

- Very safe to invest in, if the tenure is between 1 day to a month.

- Liquid Funds:

- They invest in bonds and money market instruments with maturity no longer than 91 days.

- Also, considered very safe category of funds.

- Ultra Short Duration Funds:

- These mutual funds select bonds/debt for investment such that average maturity (remaining) period for portfolio is between 3 to 6 months (Macaulay duration).

- Shorter duration funds may provide lower returns but are lesser risky to interest rate changes.

- Low Duration Funds:

- These mutual funds select bonds/debt for investment such that average maturity (remaining) period for portfolio is between 6 to 12 months (Macaulay duration).

- Money Market Funds:

- These mutual funds invest in money market instruments with maturity no longer than 12 months.

- Short Duration Funds:

- These mutual funds select bonds/debt for investment such that average maturity (remaining) period for portfolio is between 1 to 3 years (Macaulay duration).

- Medium Duration Funds:

- These mutual funds select bonds/debt for investment such that average maturity (remaining) period for portfolio is between 3 to 4 years (Macaulay duration).

- Medium to Long Duration Funds:

- These mutual funds select bonds/debt for investment such that average maturity (remaining) period for portfolio is between 4 to 7 years (Macaulay duration).

- Longer duration funds may provide higher returns but are more sensitive to interest rate changes.

- Long Duration Funds:

- These mutual funds select bonds/debt for investment such that average maturity (remaining) period for portfolio is higher than 7 years (Macaulay duration).

- Longer duration funds may provide higher returns but are more sensitive to interest rate changes.

- Credit risk funds:

- These mutual funds invest in bonds which are below highest grade rating.

- Higher the rating, lower the possibility of default. However, lower rated bonds offer higher interest rates , and thus returns.

- Gilt Funds:

- These mutual funds invest mostly in government bonds.

- Government bonds are considered the safest investment in the country.

- Fixed Maturity Plans:

- Generally have a maturity of 3 years or more.

- However these are not open-ended funds.

- Others: There are certain other bond funds as well like which do not directly are dependent on bond maturity but more on the risk or interest rates:

- Dynamic bond funds: These mutual funds invest in bonds across maturity. Maturity is adjusted based on market conditions to improve returns for the investors.

- Floater rate funds: These mutual funds invest in bonds which have floating interest rate. If interest rates goes up, then bond prices move down and reduces returns for the investors and vice a versa.

- Corporate Bond Funds: These mutual funds invest in highest rated bonds issued by corporates / companies.

- Overnight Funds:

- Solution Oriented Funds: They invest with a fixed definition in mind, like retirement funds, Children’s plan etc.

- Retirement Funds:

- These mutual funds invest in stocks and bonds, as the theme may be.

- They have a lock in period of 5 years or till the retirement age(whichever is earlier)

- Children’s Plan:

- These mutual funds invest in stocks and bonds, more having a balanced approach till the time the child matures.

- They have a lock in period of 5 years or till the majority age of the child (whichever is earlier).

- Retirement Funds:

- Fund of Funds:

- These funds create a portfolio of other mutual funds, i.e. they invest in other mutual funds.

- Investment in other funds is done to take exposure in international market or theme based funds, and reduce the direct investments into stocks.

- This also help them take advantage of a positive situations in international growing economies like Brazil, Emerging markets, developed economies like US, China etc. or assets like Gold.

- Investment in this theme can be very risky though and needs to be tread with caution.

- Index Funds / Exchange Traded Funds (ETFs):

- These mutual funds creates a portfolio which mimics given index. So these funds are expected give similar returns as per index.

- They have a lower expense ratio due to passive theme of investing.

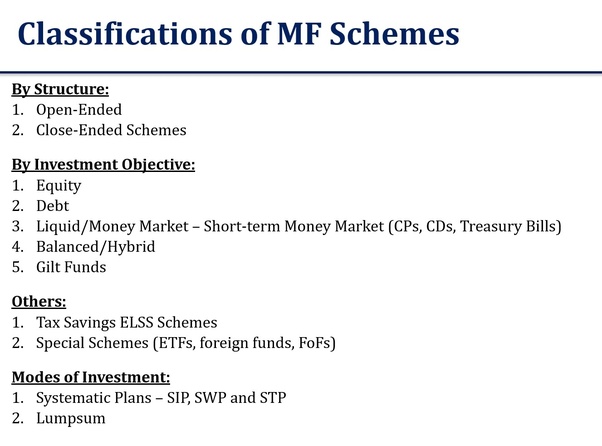

A more general classification is available in the image below for reference:

BUT WHAT ABOUT THE RETURNS?

The most important bit an investor looks at is the returns or risk-reward ratio. So let us have a look at Sensex returns.

Since inception, Sensex has returned a CAGR of more than 16%, i.e. from a base value of 100 in 1979, it has crossed 39,000 in 2019, a STAGGERING 390 times in 40 years, this excluding the dividends paid. However, considering Indian economy has been constantly developing, maintaining this CAGR may not be possible in the future.

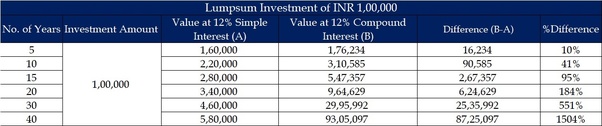

Personally I consider expecting around 11–12% CAGR from equity as reasonable for the next decade or two. Let us look at some calculations to understand that if we are patient and invest with a long term view, how can our wealth be created.

- For a lumpsum investment of INR 1,00,000, below is the comparison for Simple and Compound Interest. Staying invested will compound your values. It can convert to INR 2.5 Crores in 30 years at 12% CAGR.

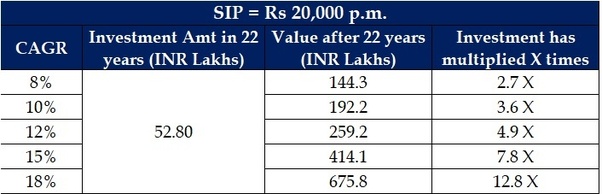

- If I do an SIP of INR 20,000 per month for 22 more years (say early retirement), I still generate INR 2.59 Crores. Does it WOW you?

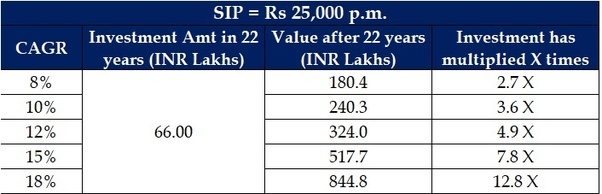

- If I increase my investment by INR 5,000, i.e. INR 25,000 p.m. for the same 22 years, I may be able to generate almost INR 50L – 1 Crore additional at the same rates.

Now, for facts, let us look at certain wealth creators over the last 3 and 5 years periods:

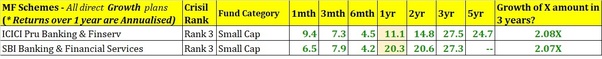

- DOUBLED in 3 years: Following DOUBLE investors’ wealth in the last 3 years !!

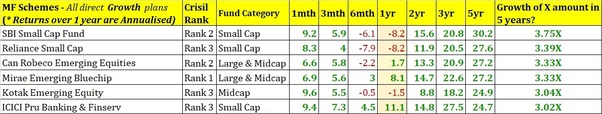

- TRIPLED in 5 years: Following TRIPLED investors’ wealth in the last 5 years!!

ADVICE: Past performance may not be repeated in the future. So, always analyze the current trend and portfolio along with your requirements before investing.

Conclusion:

- One needs to understand his / her risk appetite, investment horizon, goals and then accordingly map the same to various available mutual fund instruments.

- Asset allocation is one of the most crucial parts of investment planning. Do not avoid it.

- Consult a financial adviser if in doubt, but ensure you understand the different MF categories and the planning is properly done before you start investing.

- Plan your goals and aim to achieve them. This will ensure your goals are met as targeted.